Broadcom Inc. (AVGO) Stock Price Today: A Comprehensive Analysis by Zacks

Table of Contents

- AVGO Stock Price and Chart — TradingView

- AVGO Stock Price and Chart — TradingView

- AVGO Stock Price and Chart — TradingView

- AVGO Stock Price and Chart — NASDAQ:AVGO — TradingView

- Broadcom Stock (NASDAQ:AVGO): Is More Upside Likely? | Nasdaq

- Qualcomm Stock Is a More Solid Trade With This Pairing | InvestorPlace

- Broadcom (AVGO) Stock: Why this thriving chipmaker remains an investors ...

- AVGO: 3 Tech Stocks to Buy on a Market Pullback

- AVGO Stock Price Prediction News Today 9 March - Broadcom Inc - YouTube

- Broadcom Inc. (AVGO) Stock Price, News, Quote & History - Yahoo Finance

Investors seeking to diversify their portfolios often look for stocks with a strong potential for growth and stability. One such stock that has been making waves in the market is Broadcom Inc. (AVGO). As a leading semiconductor and software company, Broadcom has been consistently delivering impressive performance, making it an attractive choice for investors. In this article, we will delve into the current stock price of Broadcom, its performance, and the analysis by Zacks, a renowned investment research firm.

Current Stock Price of Broadcom (AVGO)

As of the latest trading session, the stock price of Broadcom Inc. (AVGO) stands at $

Performance Analysis by Zacks

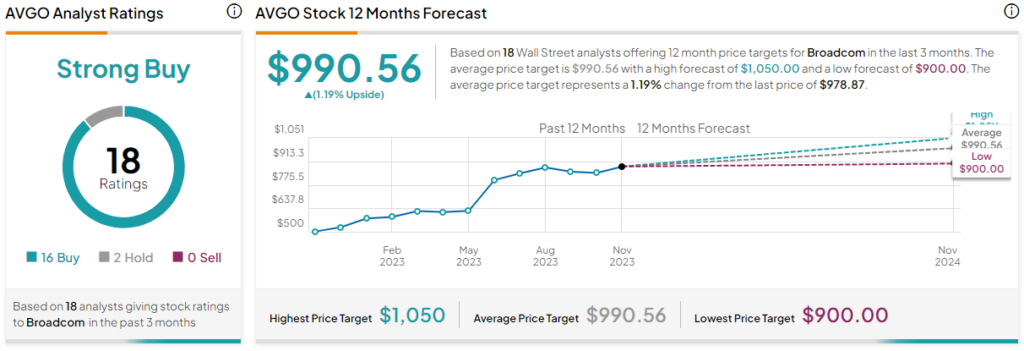

Zacks, a well-respected investment research firm, provides comprehensive analysis and ratings for stocks, including Broadcom. According to Zacks, Broadcom has a strong buy rating, with a Zacks Rank of #

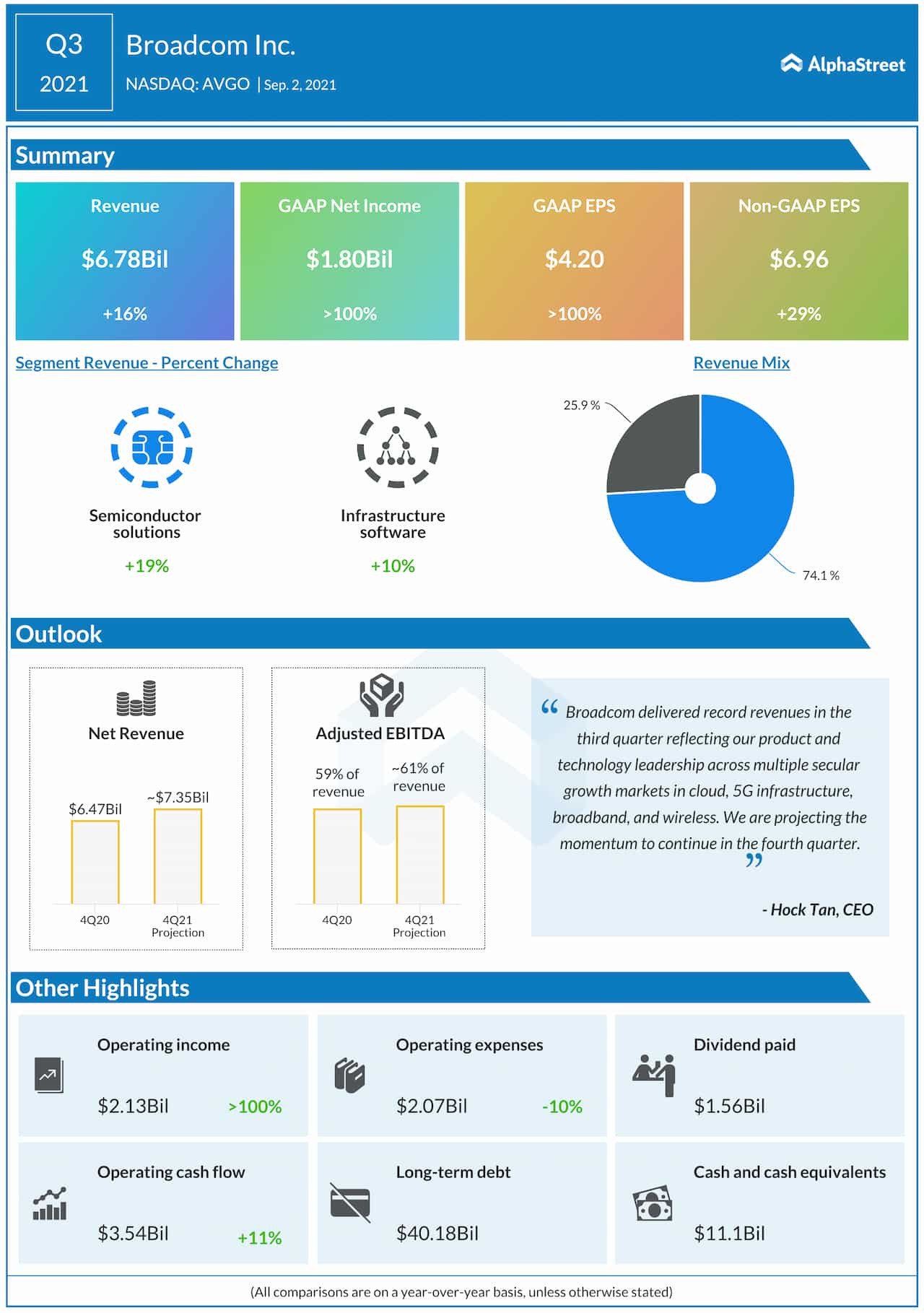

Zacks' analysis highlights Broadcom's strengths, including its dominant position in the semiconductor market, its diversified product portfolio, and its strong research and development capabilities. The firm also notes that Broadcom's strategic acquisitions, such as its purchase of CA Technologies, have expanded its product offerings and enhanced its competitive position.

Growth Prospects and Future Outlook

Looking ahead, Broadcom's growth prospects appear promising. The company is well-positioned to benefit from the growing demand for semiconductor products, particularly in the areas of 5G, artificial intelligence, and the Internet of Things (IoT). Additionally, Broadcom's software segment is expected to drive growth, driven by its strong portfolio of enterprise software products.

According to Zacks, Broadcom's earnings are expected to grow by

In conclusion, Broadcom Inc. (AVGO) is a stock that warrants consideration for investors seeking growth and stability. With its strong financials, innovative products, and strategic acquisitions, the company is well-positioned for long-term success. Zacks' analysis provides a comprehensive overview of the company's performance, highlighting its strengths and growth prospects. As the demand for semiconductor products continues to grow, Broadcom is likely to remain a leading player in the industry, making it an attractive choice for investors. With its current stock price and strong growth prospects, Broadcom Inc. (AVGO) is definitely a stock to watch in the coming months.

Note: Please replace