As the summer of 2024 heats up, many employers and employees are preparing for the upcoming minimum wage increases set to take effect in July. These changes will impact businesses and workers across the country, and it's essential to stay informed to ensure compliance and plan accordingly. In this article, we'll break down the July 2024 minimum wage increases, courtesy of

OnPay, and what they mean for you.

Which States and Cities Are Affected?

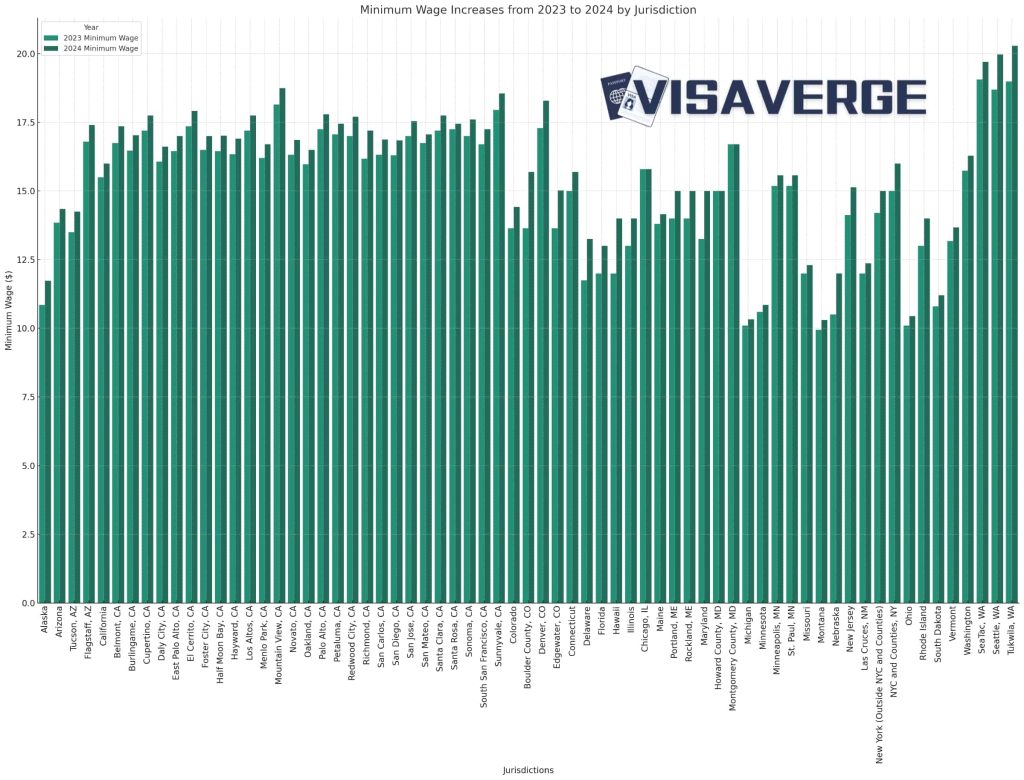

Several states and cities will see minimum wage increases in July 2024. Some of the notable changes include:

California: The minimum wage will rise to $15.50 per hour for employers with 26 or more employees.

New York: The minimum wage will increase to $15.00 per hour for most employers.

New Jersey: The minimum wage will rise to $14.13 per hour for most employers.

Illinois: The minimum wage will increase to $13.00 per hour for most employers.

Cities like Seattle, Washington, and San Francisco, California, will also see minimum wage increases.

What Do These Increases Mean for Employers?

The July 2024 minimum wage increases will require employers to adjust their payroll and budget accordingly. Here are a few key takeaways for employers:

Review and update employee contracts: Ensure that all employee contracts and agreements reflect the new minimum wage rates.

Adjust payroll and benefits: Update payroll systems and benefits packages to account for the increased minimum wage.

Plan for potential budget impacts: Consider the potential impact of the minimum wage increase on your business's budget and plan accordingly.

What Do These Increases Mean for Employees?

The July 2024 minimum wage increases will result in higher earnings for many employees. Here are a few key takeaways for employees:

Increased take-home pay: Employees will see an increase in their take-home pay, which can help with living expenses and savings.

Improved benefits and perks: Some employers may offer improved benefits and perks to attract and retain top talent in a competitive job market.

Greater financial stability: The minimum wage increase can provide greater financial stability and security for employees and their families.

Staying Compliant with OnPay

At OnPay, we understand the importance of staying compliant with changing labor laws and regulations. Our payroll and HR software is designed to help employers navigate the complexities of minimum wage increases and other labor laws. With OnPay, you can:

Automate payroll and benefits: Streamline your payroll and benefits processes with our intuitive and user-friendly software.

Stay up-to-date on labor laws: Receive timely updates and alerts on changing labor laws and regulations, including minimum wage increases.

Ensure compliance and accuracy: Trust OnPay to help you ensure compliance and accuracy in your payroll and HR processes.

In conclusion, the July 2024 minimum wage increases will have a significant impact on employers and employees across the country. By staying informed and planning ahead, businesses can ensure compliance and thrive in a changing labor landscape. With OnPay, you can trust that your payroll and HR processes are in good hands.

Contact us today to learn more about our payroll and HR software and how we can help you navigate the July 2024 minimum wage increases.