As the new year unfolds, employers and taxpayers alike are gearing up to navigate the complexities of the US tax system. One crucial resource that can help simplify this process is the

PDF 2024 Publication 15-A, provided by the Internal Revenue Service (IRS). In this article, we will delve into the details of this publication, exploring its key components, updates, and how it can assist employers in meeting their tax obligations.

Introduction to Publication 15-A

The Publication 15-A, also known as the "Employer's Supplemental Tax Guide," is a supplementary resource to the main Publication 15, "Circular E, Employer's Tax Guide." It is designed to provide additional guidance and explanations on specific topics related to employer taxation, ensuring that employers are well-equipped to handle their tax responsibilities accurately and efficiently.

Key Components of the 2024 Publication 15-A

The

PDF 2024 Publication 15-A covers a wide range of topics, including:

Employer Identification Number (EIN): The process of obtaining and using an EIN for tax purposes.

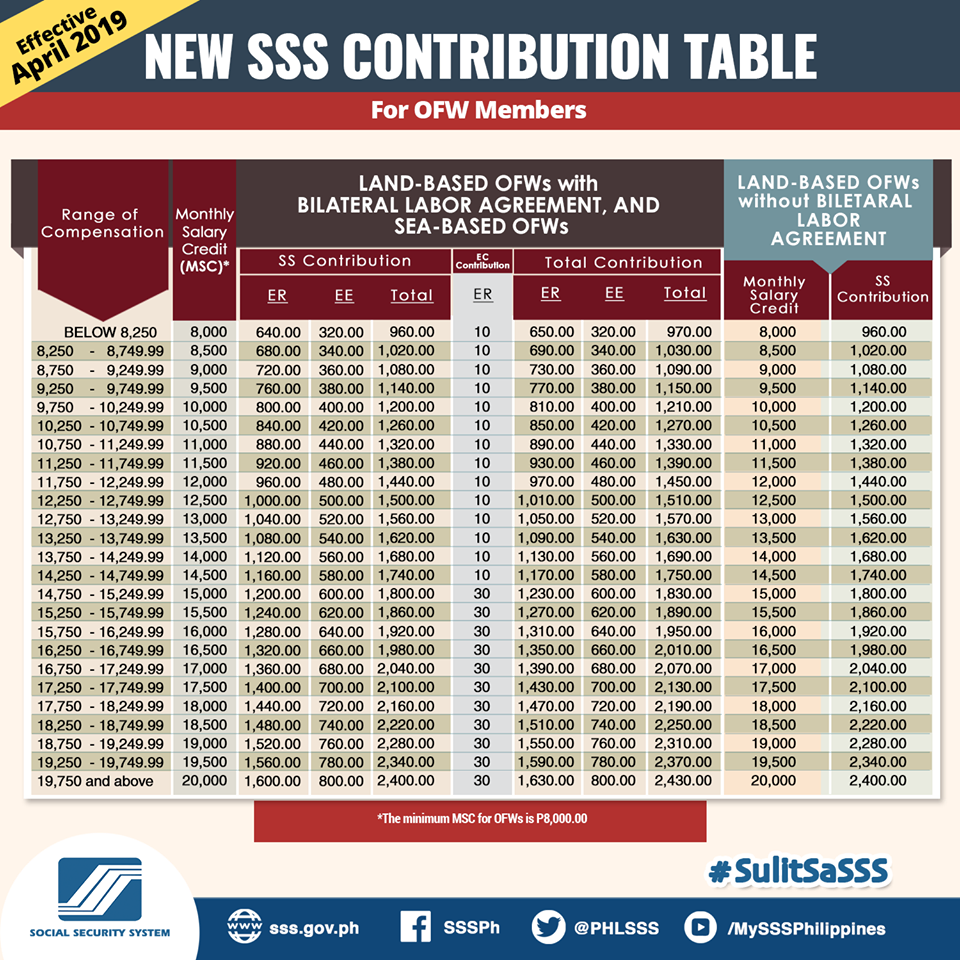

Employment Taxes: Detailed explanations of federal income tax withholding, social security and Medicare taxes, and federal unemployment tax.

Depositing Employment Taxes: Guidelines on when and how to deposit employment taxes, including the use of the Electronic Federal Tax Payment System (EFTPS).

Reporting Employment Taxes: Instructions on completing and filing Form 941, Employer's Quarterly Federal Tax Return, and other relevant forms.

Updates in the 2024 Publication 15-A

Each year, the IRS updates the Publication 15-A to reflect changes in tax laws, regulations, and procedures. The 2024 edition includes updates on:

Tax Law Changes: Information on recent tax law changes and how they affect employer taxation.

Form Updates: Changes to tax forms and instructions, ensuring employers use the most current versions.

Electronic Filing: Encouragement and guidance on electronic filing and payment options to streamline the tax process.

Benefits of Using the 2024 Publication 15-A

Employers can benefit significantly from consulting the

PDF 2024 Publication 15-A, as it:

Simplifies Tax Compliance: By providing clear guidance and explanations, employers can more easily understand and meet their tax obligations.

Reduces Errors: Following the instructions and guidelines in the publication can help minimize errors in tax deposits, reporting, and compliance.

Enhances Record-Keeping: The publication offers tips and best practices for maintaining accurate and comprehensive tax records.

The

PDF 2024 Publication 15-A is an indispensable resource for employers seeking to navigate the complexities of US taxation. By understanding the key components, updates, and benefits of this publication, employers can ensure they are in compliance with all tax laws and regulations, reducing the risk of errors and penalties. As the tax landscape continues to evolve, staying informed with the latest guidance from the IRS is crucial for successful tax management. Download the

PDF 2024 Publication 15-A today and take the first step towards a smoother, more compliant tax season.