Unlocking Investment Potential: A Deep Dive into IVV - iShares Core S&P 500 ETF

Table of Contents

- iShares Core S&P 500 UCITS ETF USD (Acc) | SXR8 | IE00B5BMR087

- IVV Sixties Set of 6 Tumbler - Clear - Artelia

- IVV abstract technology logo design on white background. IVV creative ...

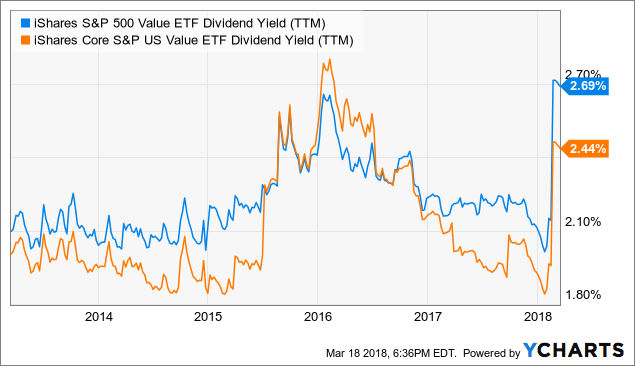

- iShares S&P 500 Value ETF: A Decent Fund, But Better Options Exist For ...

- IVV Multicolor 25CL Tumbler - Amthyst - Artelia

- IVV - 2Modern

- What Are iShares Core S&P 500 ETFs?

- Detail akcie ISHARES CORE S&P 500 ETF online - Patria.cz

- Ishares Core S P 500 Etf Chart - Ponasa

- Why iShares S&P 500 ETF (ASX:IVV) could be a really smart investment

Introduction to IVV - iShares Core S&P 500 ETF

Performance Overview

Benefits of Investing in IVV

1. Diversification: By investing in IVV, you gain exposure to 500 of the largest U.S. companies, reducing reliance on any single stock. 2. Low Costs: IVV is known for its low expense ratio, making it a cost-effective way to invest in the S&P 500. 3. Flexibility: As an ETF, IVV can be traded throughout the day, allowing for quick adjustments to your portfolio as market conditions change. 4. Transparency: The holdings of IVV are transparent and available daily, ensuring you always know what you own. For investors seeking a straightforward, cost-effective way to tap into the performance of the U.S. stock market, the iShares Core S&P 500 ETF (IVV) stands out as a compelling choice. With its broad diversification, low costs, and flexibility, IVV can serve as a core component of a long-term investment strategy. Whether you're a beginner looking to start your investment journey or a seasoned investor aiming to optimize your portfolio, IVV's track record and the insights provided by Morningstar make a strong case for its inclusion in your investment portfolio. As with any investment, it's essential to conduct thorough research and consider your financial goals, risk tolerance, and time horizon before investing in IVV or any other ETF. By doing so, you can make informed decisions that align with your investment objectives and work towards achieving your long-term financial goals. Remember, investing in the stock market involves risks, and there are no guarantees of returns. However, with a well-diversified portfolio that includes a core holding like IVV, you can position yourself for potential long-term success in the world of investing.Disclaimer: The information provided in this article is for educational purposes only and should not be considered as investment advice. It's always recommended to consult with a financial advisor before making any investment decisions.